The Cost of Secondary School Education 2025

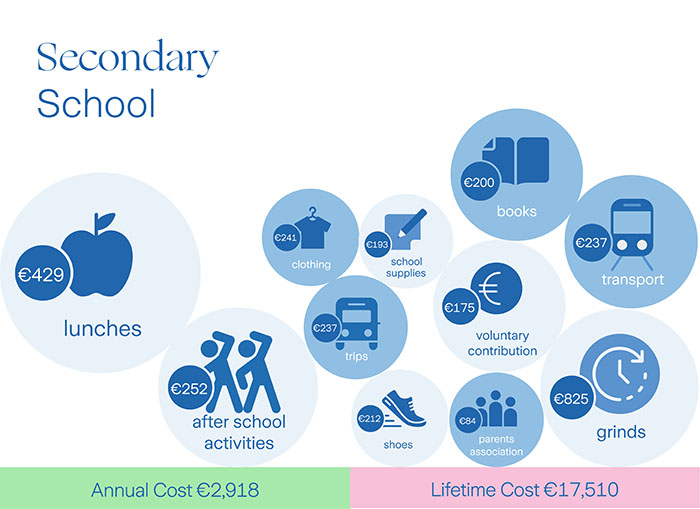

Children in Ireland are entitled to free education, but each year back-to-school costs are rising for families. The 2025 Zurich Cost of Education Survey1 highlights the increasing cost of secondary school in Ireland. Here's a list of expenses you can expect to pay each year and the lifetime cost of putting just one child through secondary education.

Source: 1Zurich Cost of Education Survey 2025

When it comes to secondary school costs, it comes as no surprise that grinds are the most sizeable expense, costing on average €825 per child per year. The move to secondary school also brings a greater number of other expenses such as lunches (€429), transport (€237), clothing (€241) and books (€200).

Our research into the cost of secondary school also reveals that parents underestimate the cost of secondary school believing it to be €2,065 for one child per school year. However, our study uncovers that the cost is higher at €2,918. Things like school trips (€237) and after school activities (€252) are certainly adding to the costs for parents of secondary school children. If we allow for the fact that the bulk of schoolbooks will be bought in first and fifth year in the build-up to junior cert and leaving cert cycles respectively, the total cost of six years' secondary school education, extra expenses excluded, is estimated to be €17,510.

Some other interesting findings from our research reveals:

- 55% of children in secondary school are still required to have hard copies of books.

- 43% of secondary parents want a more widespread move to digital learning.

- 24% of parents have taken out a loan to help pay for their children’s secondary school costs.

- 57% of parents say their secondary school aged child requires a full branded uniform.

- The most popular modes of transport to school for secondary school students is the car (52%) and walking (42%), with public transport at 18%.

- The majority (60%) of secondary school students take a packed lunch to school with them. The average amount parents spend on their children’s lunch per annum is €429.

A breakdown of secondary school costs*

| Item | Estimated Cost |

|---|---|

| Grinds | €825 |

| Lunches |

€429 |

| After school activities |

€252 |

| Clothing |

€241 |

| Transport |

€237 |

| Trips |

€237 |

| Shoes |

€212 |

| Books | €200 |

| School supplies | €193 |

| Voluntary contribution | €175 |

| Parents association | €84 |

| Annual cost | €2,918 |

| Lifetime cost |

€17,510 |

What are the parents using the child benefit for?

Child benefit is a payment parents receive each month and amounts to €140 per child per month regardless of income or means.

When we carried out our research into the cost of education in Ireland, we asked parents what do they do with the child benefit each month?

For secondary school parents, 57% said household outgoings is the top use for the child benefit for parents of secondary school students, while 23% save the child benefit, compared to 30% of primary parents.

It's clear to see that the cost of education is high and increases over the years. So, wouldn't it make sense to plan ahead and build up your savings year-on-year?

With a Regular Savings plan you can gradually build up the funds necessary to support your children's education.

The table below illustrates just how much regular savings can grow with a Zurich LifeSave Savings Plus plan. For example, if you saved the Government child benefit of €140 per month for five years (as of August 2025) in the Prisma 4 fund from when your child was born, by the time they started school you could have built up savings of €8,954 in time to fund this crucial stage in their education.

| Potential savings fund after five years | Potential savings fund after 12 years | |

|---|---|---|

| Regular contributions of €140 per month* | €8,954 |

€23,605 |

| Lump sum of €10,000 and regular contributions of €140 per month* | €20,119 | €37,040 |

|

A gross investment return of 5.2% per annum is assumed for the 5 year savings fund and 5.5% per annum for the 12 year savings fund. We have assumed that on death, encashment, partial encashment or assignment of the policy or on each 8th policy anniversary, tax is deduced on the gains made at the current rate of taxation, being 41%. A government insurance levy (currently 1% as at August 2025 and may change in the future) applies to this policy. The lump sum contribution amounts above are inclusive of this levy. No surrender penalties apply. An annual management charge of 1.35% and an allocation rate of 101% apply. The information contained herein is based on Zurich Life's understanding of current Revenue practice as of August 2025 and may change in the future. |

||

Cost of education calculators

Our Cost of Secondary School Calculator is a tool that helps you work out how much you need to save to cover the costs of putting children through secondary school.

Cost of Secondary School Calculator

Use our Cost of College Education Calculator to work out the estimated costs of sending your children to college and to see how much you might need to save each month to meet these college costs.

Benchmarking tool

Use Zurich's Cost of Education benchmarking tool to see how education costs compare and pinpoint where savings could be made.