The Cost of Primary School Education 2024

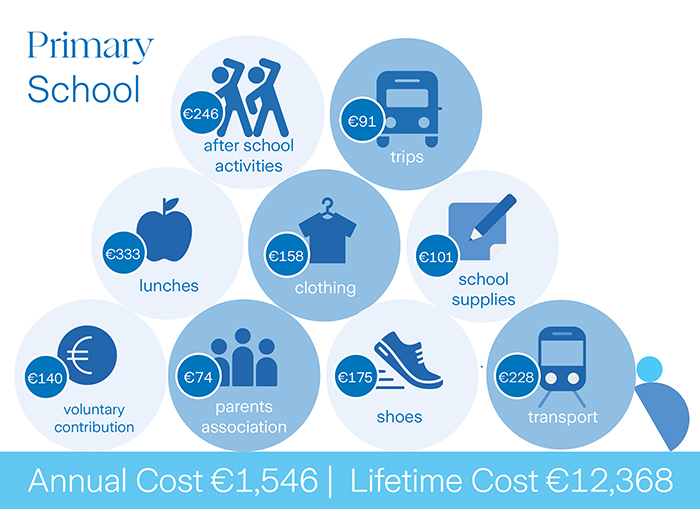

The 2024 Zurich Cost of Education Survey1 highlights the increasing cost of primary school in Ireland. Here's a breakdown of what you can expect to spend each year for one child, and the lifetime cost of primary education.

Source: 1Zurich Cost of Education Survey 2024

It all starts here; your child's first days at school are a big milestone. Their first day at school is also your first day of many years of worthwhile expense and investment.

The Zurich Cost of Education research reveals that the average cost of sending a child to primary school each year is €1,546 down €325 compared to last year. This is likely due to the introduction of free schoolbooks for children in primary school.

Often the first thing that comes to mind for parents counting the cost of sending their children to primary school is the cost of school uniforms and transport, and while these items do account for a substantial expense, they are not the only costly item on the back-to-school shopping list.

The research found that in primary school, the highest costs are lunches €333, school activities €246, and transport €228. When adding up all the figures, the total cost of eight years' primary school education certainly adds up and comes in at an estimated €12,368.

Some other interesting findings from our research shows:

The most popular mode of transport to school for primary school students is the car (67%), up 8% compared to 2023. Walking has also increased by 3% to 45%.

- 71% of primary school students take a packed lunch to school with them, up 2% from last year. 23% eat in the school canteen.

- 26% of parents are eligible for the B2S clothing and footwear allowance (-17% from 2023).

- 50% of primary school parents use the child benefit they receive for day-to-day child costs. 38% use it for household outgoings, 26% save it and only 18% use if for education costs.

- 14% have taken out a loan to help pay for their children’s primary school costs, down 11% from 2023.

A breakdown of primary school costs*

| Item | Estimated Cost |

|---|---|

| Lunches | €333 |

| After school activities | €246 |

| Transport |

€228 |

| Shoes |

€175 |

| Clothing |

€158 |

| Voluntary contribution |

€140 |

| School supplies |

€101 |

| Trips | €91 |

| Parents association | €74 |

| Annual cost | €1,546 |

| Lifetime cost |

€12,368 |

*Assumption: For the lifetime cost of primary education, we have assumed eight years of costs for eight years of primary education.

Saving solutions

There are some measures parents can take to reduce the cost of sending their children to primary school, such as providing packed lunches, walking to school and availing of book rental schemes. Other solutions to minimising the financial burden of children's education is early planning and financial saving.

Looking specifically at parents' saving behaviour, the Zurich Cost of Education research found that parents that have a savings account say one of their top saving priorities is to cover their children's education costs.

What are parents using the child benefit for?

Child benefit is a payment parents receive each month and amounts to €140 per child per month regardless of income or means.

When we carried out our research into the cost of education in Ireland, we asked parents what do they do with the child benefit each month?

For primary school parents, 50% use the child benefit for day-to-day child costs. 38% use it for household outgoings, and just over 1 in 4 save it.

It's clear to see that the cost of education is high and increases over the years. So, wouldn't it make sense to plan ahead and build up your savings year-on-year?

With a Regular Savings plan you can gradually build up the funds necessary to support your children's education.

The table below illustrates just how much regular savings can grow with a Zurich LifeSave Savings Plus plan. For example, if you saved the Government child benefit of €140 per month for five years (as of August 2024) in the Prisma 4 fund from when your child was born, by the time they started school you could have built up savings of €8,784 in time to fund this crucial stage in their education.

| potential Savings fund after five years | potential Savings fund after 12 years | |

|---|---|---|

| Regular contributions of €140 per month* | €8,784 |

€22,589 |

| Lump sum of €10,000 and regular contributions of €140 per month* | €19,749 | €35,159 |

|

A gross investment return of 4.6% per annum is assumed for the 5 year savings fund and 4.6% per annum for the 12 year savings fund. We have assumed that on death, encashment, partial encashment or assignment of the policy or on each 8th policy anniversary, tax is deduced on the gains made at the current rate of taxation, being 41%. Contribution increases of 3% per annum are assumed. A government insurance levy (currently 1% as at August 2024 and may change in the future) applies to this policy. The contribution amounts above are inclusive of this levy. No surrender penalties apply. An annual management charge of 1.35% and an allocation rate of 101% apply. The information contained herein is based on Zurich Life's understanding of current Revenue practice as of August 2024 and may change in the future. |

||

Cost of education calculators

Our Cost of Secondary School Calculator is a tool that helps you work out how much you need to save to cover the costs of putting children through secondary school.

Cost of Secondary School Calculator

Use our Cost of College Education Calculator to work out the estimated costs of sending your children to college and to see how much you might need to save each month to meet these college costs.

Benchmark Tool

Use Zurich's Cost of Education benchmarking tool to see how education costs compare and pinpoint where savings could be made.