What happens when you retire?

What happens when you retire?

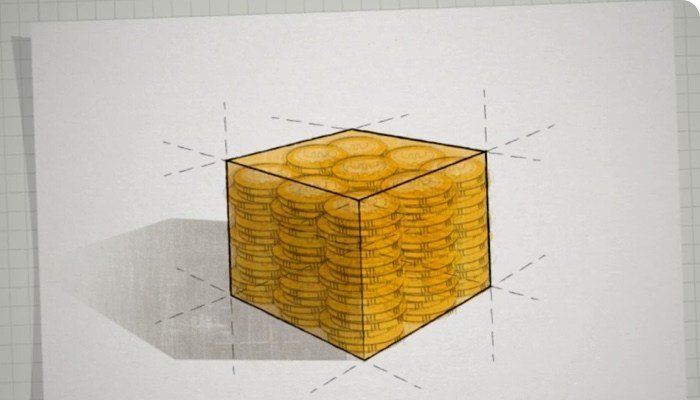

Our retirement income guide explains what your options are when you to retire from work and how you can make the most out of your pension. A pension is a way of saving for your retirement. Hopefully by the time you retire you'll have built up a substantial pot. At that point, you have to turn it into an income.

A pension is a way of saving for your retirement. Hopefully by the time you retire you'll have built up a substantial pot. At that point, you have to turn it into an income.

You can exchange your savings for a guaranteed income that will be paid out for the rest of your days - it's predictable and steady. This is called an annuity. Essentially, you buy yourself a paycheque.

Or you can reinvest your savings in funds, with the intention of living off the investment and the returns it makes (an ARF - Approved Retirement Fund). Funds fluctuate in value, so you'll have to plan carefully so that your savings last as long as you need them to.

There's no right answer - just what's right for you. That might depend on the value of your pension when you retire, whether you want to pass on your investment to the people you care about or the level of risk you're open to.

Whether this is a choice you'll be making in three months or thirty years, you'll need to get some professional advice. So talk to a financial broker or advisor you trust, and choose the right retirement for you.