The Managed fund range from Zurich: Celebrating 35 years of experience and growth

Recently we reached a significant milestone for Zurich’s range of Managed funds – the Balanced, Performance, and Dynamic funds – as they celebrated 35 years of delivering for investors.

These funds, launched in 1989 and now among Ireland’s longest-running investment options, have accumulated over €8 billion in investments*, underscoring their enduring popularity and the trust placed in them by Financial Brokers over the decades.

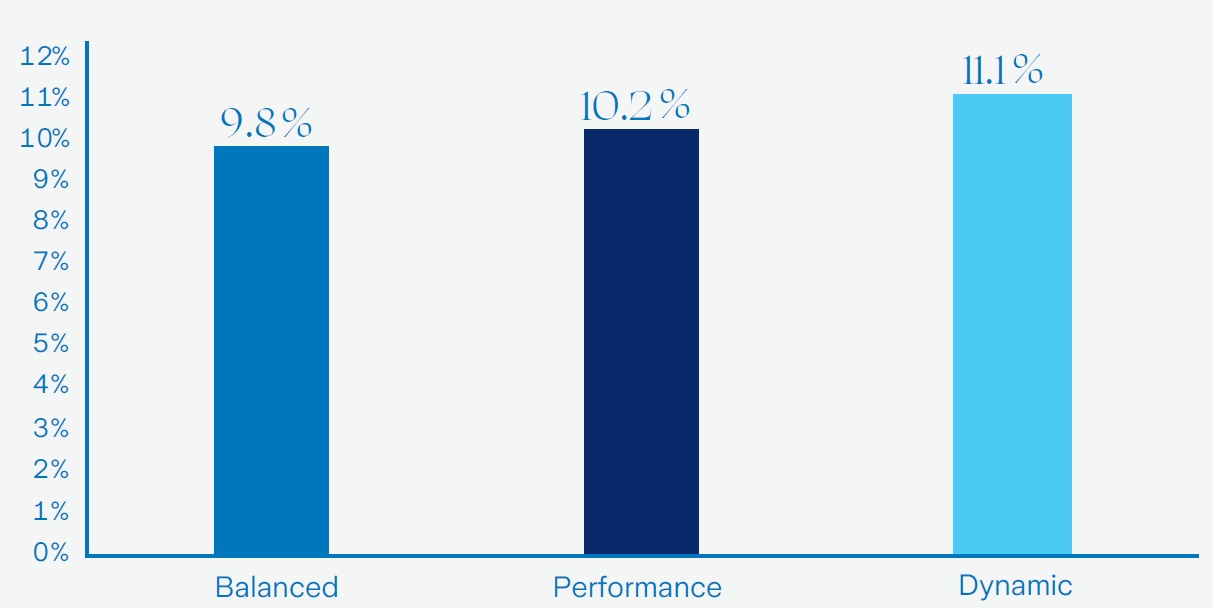

While in recent years, the Prisma Funds have attracted significant interest from investors they are based on the same process as the Managed fund range which continues to effectively showcase Zurich Investments performance track record and pedigree. For example, the Balanced Fund has delivered 9.8% per annum since launch*, despite all the highs and lows of the last 35 years. And a lot has happened across the past four decades.

From the fall of the Berlin Wall, through Brexit and culminating with the recent US election held the same week as the 35-year anniversary of the Managed fund range, financial markets are continually changing and evolving alongside global developments. Macro and micro-economic trends can and do have direct financial market impacts. But it’s this rapid change that provides opportunities to investment managers who take a ‘hands-on’ active approach to making the right decisions at the right time.

Over the past 35 years Zurich Investments have been managing diversified multi-asset funds for investors throughout Ireland. They have successfully navigated the markets; making active investment decisions that yield long-term value for your clients. Since inception, the Managed fund range has demonstrated strong growth, providing investors with a reliable path to achieving their financial goals.

Annualised performance since inception of the Managed fund range

Source: Zurich and FE fund info, November 2024. Annualised performance since launch: Returns are based on offer/offer performance and do not represent the return achieved by individual policies linked to the fund with date ranges from launch 01/11/1989 to 01/11/2024. Annual management fees apply. The actual returns on policies linked to these funds will depend on the charges on the individual policies that invest and may be different than illustrated here.

What makes Zurich Investments different?

Strong track record: Zurich Life has been meeting your clients’ needs in Ireland for over 40 years*. We are proud of our track record in managing customers’ investments. We believe that good active investment managers are best placed to deliver consistent long-term performance.

Active outperformance: The team adopt an active approach to all levels of the investment process – asset allocation, geographical bias, sector preference and stock selection. They are prepared to take meaningful and even contrarian positions if required, making investment decisions every day that they think will lead to a better outcome for your clients.

Skill based: Zurich Investments’ fund managers come from a wide variety of academic backgrounds and combine decades of experience in investment management.

Accountability: Team members have clear individual responsibilities either in specific asset classes, regions or investment portfolios and are accountable to the Chief Investment Officer for their own investment performance and mandate-adherence.

Process driven: The key to successful multi-asset investing is making timely asset allocation decisions and the Zurich Investments team have excelled in this area. Our Top-Down investment process is driven by continuous analysis of the economic and market cycles.

Investing responsibly for future generations

As an investment manager, Zurich Life Assurance plc is conscious of the need to ensure that we invest policyholder and shareholder funds responsibly. For us, Responsible Investment is all about ‘doing well and doing good’. In line with this philosophy, the Managed funds are classified under SFDR Article 8, reflecting our commitment to promoting sustainable characteristics in our investment decisions.

35 years of expertise, three powerful funds, one proven track record

Today Zurich manage approximately €40 billion in investment assets and have a reputation for delivering consistent outperformance.*

The Managed fund range is available across the Zurich suite of Individual and Corporate Pensions, Approved Retirement Funds and Savings and Investment products.

For more information on the full range of Zurich multi-asset funds speak to your Zurich Broker Consultant or visit zurichbroker.ie.

*Source: Zurich, November 2024

Warning: Past performance is not a reliable guide to future performance.

Warning: Benefits may be affected by changes in currency exchange rates.

Warning: The value of your investment may go down as well as up.

Warning: If you invest in these products you may lose some or all of the money you invest.