October 2024 monthly investment news

Last month was a busy month for global central banks as the US Federal Reserve implemented a 50-basis point rate cut, writes Richard Temperley.

Inflation in the US decreased to 2.5% year-over-year in August, the lowest since February 2021, and a weak nonfarm payroll report supported a 50-basis point cut over a 25-basis point cut.

Equity markets reacted positively to the Fed’s decision, with global equity markets hitting new all-time highs, though the bond market rally’s momentum slowed after the decision. It is anticipated that the Fed will continue to ease policy gradually in the coming months and may accelerate the pace if economic data fails to meet expectations.

Meanwhile, in Europe, the European Central Bank (ECB) executed its second rate cut of the year in September, reducing the deposit facility rate to 3.5%. Economic activity in the Eurozone has been somewhat disappointing, with unsatisfactory growth and persistently high service inflation, though improving global monetary conditions could provide a boost.

Market activity

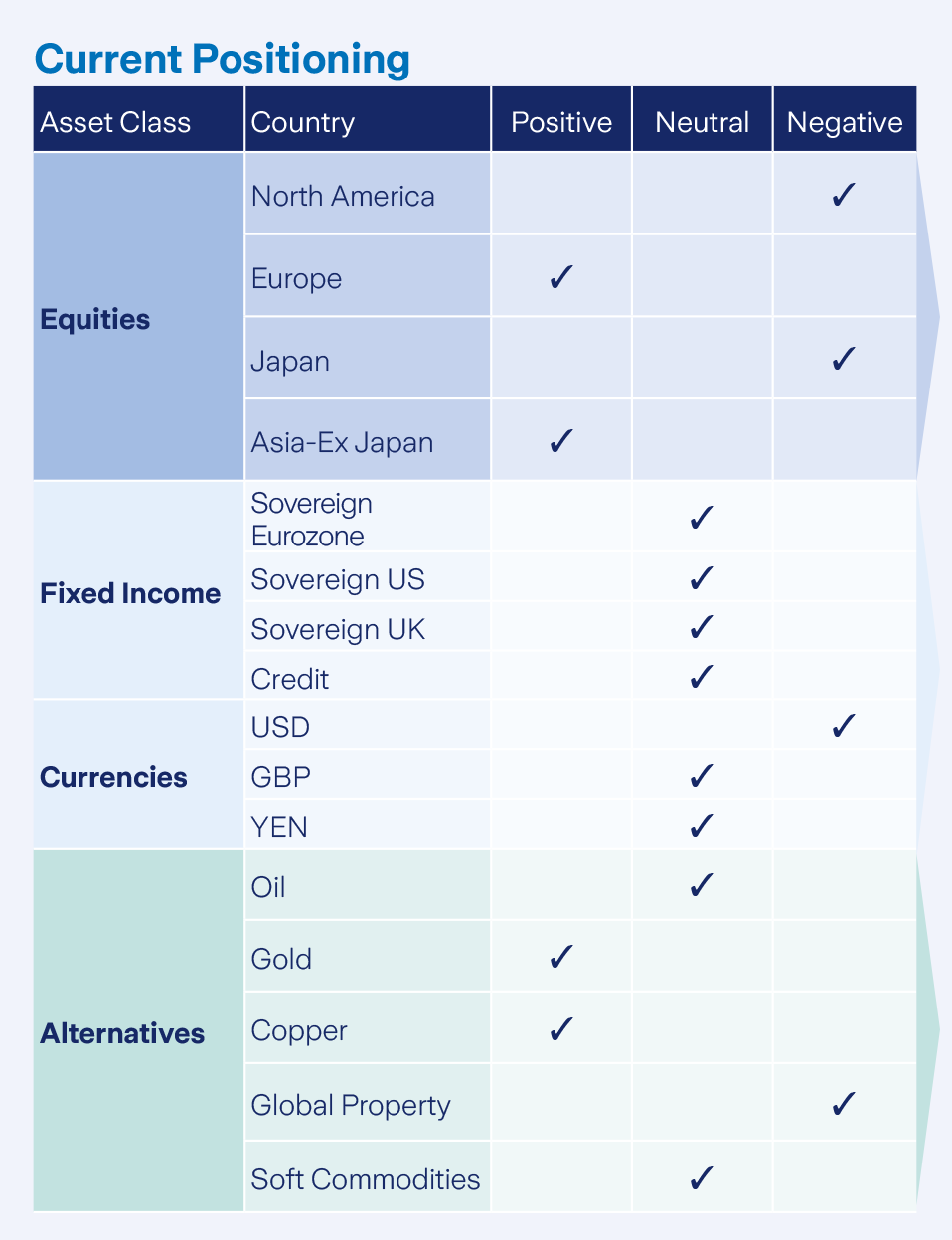

Throughout September there have been no material changes in asset allocation. Our current positioning is broadly neutral equities. We prefer equities in regions such as Asia and Europe.

We are underweight equity in North America (which includes both the US and Canada) and Japan. We have an equity sector preference for consumer discretionary and industrials, while we are underweight in sectors such as energy and healthcare.

In fixed income allocation, we hold an overweight position in short-dated bonds over long-dated government bonds. We are overweight Gold in the Active Asset Allocation fund. Additionally, our partial Euro/Dollar hedge remains in place.

Equity markets

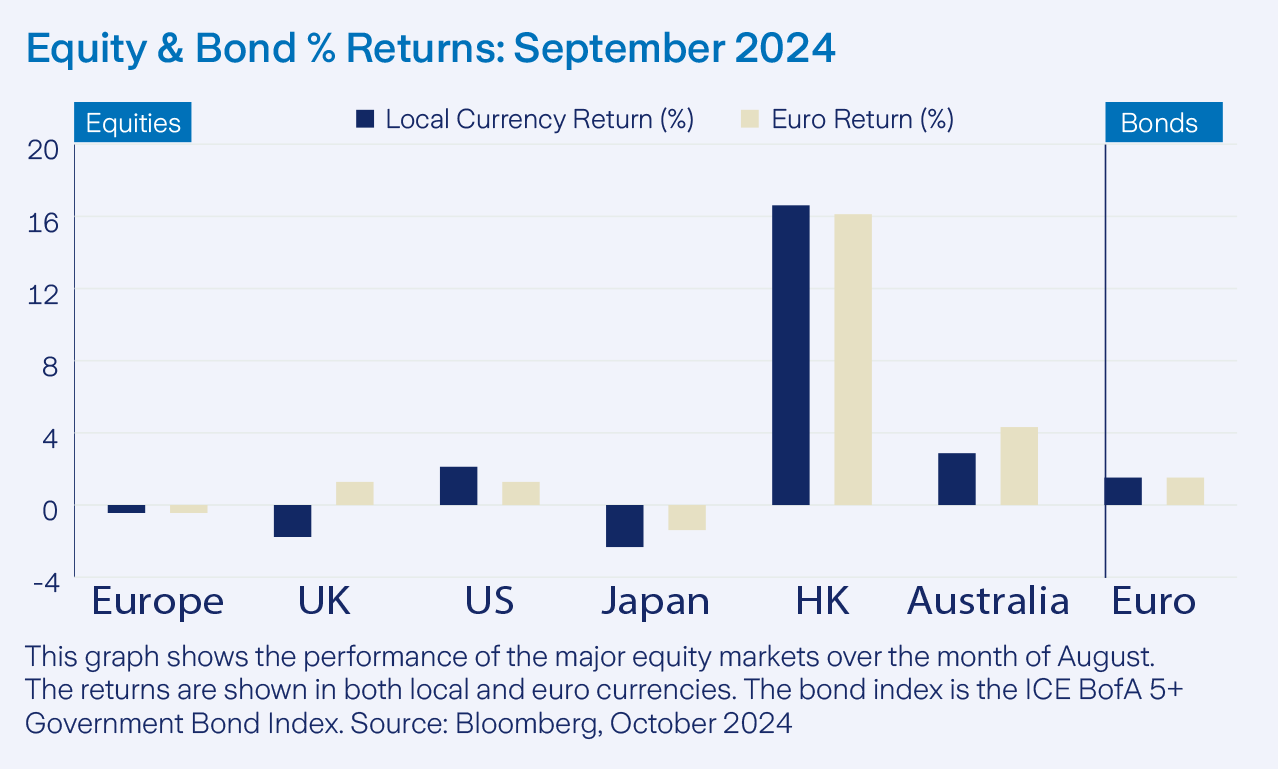

Global equities posted another positive month in September. Equities gained momentum leading up to the FOMC meeting on September 18th, where the US Federal Reserve’s 50-basis point rate cut exceeded earlier expectations and boosted investor confidence.

In contrast, European markets slowed in September. Economic growth has stagnated in many parts of the region, while inflationary pressures have largely eased. Nine out of eleven sectors ended September positively in euro terms, with utilities and consumer discretionary leading the gains at 4.6% and 4.4%, respectively. The energy and health care sectors declined, with the energy sector returning -4.0% and health care decreasing by -3.7%.

Bonds and interest rates

Bond markets delivered positive returns throughout September as yields declined in response to the Fed’s first rate cut. The benchmark US 10-Year Treasury yield ended the month lower at 3.78%, down from 3.90% at the close of August. The Federal Reserve implemented a 50-basis point rate cut at its September meeting.

Inflation and labour market data supported the Fed’s decision. The Consumer Price Index rose by 2.5% and Core Personal Consumption Expenditures by 2.7% year-over-year, while nonfarm payrolls missed expectations for the second month in a row.

Commodities and currencies

Commodity markets showed mixed performance in September. Oil prices were notably volatile, ending the month down -8.0% in Euro terms. In contrast, Gold continued to reach new highs, gaining 4.4% in Euro terms, driven partially by what is expected to be a series of interest rate cuts by the Federal Reserve. Copper also had a strong month, with the base metal often considered a gauge of global economic health, experiencing a rise of 5.5%. The USD weakened against the Euro, with one Euro buying 1.11 USD by the end of the month.

Warning: Past performance is not a reliable guide to future performance.

Warning: Benefits may be affected by changes in currency exchange rates.

Warning: The value of your investment may go down as well as up.

Warning: If you invest in these products you may lose some or all of the money you invest.