November 2024 monthly investment news

In October, global markets displayed a mix of resilience and caution, marked by significant volatility due to fluctuating economic indicators, writes Richard Temperley.

October saw major equity markets either remain flat or post negative monthly returns. In the US, equity markets ended the month mostly unchanged after a sell-off in technology giants led to Wall Street’s steepest daily decline in nearly two months following earnings reports.

European equities encountered challenges from mixed economic data and inflationary pressures, which continued to shape central bank policies. Notably, the European Central Bank reduced rates by another 25 basis points in October.

A primary focus this month was the rise in Treasury yields. Factors contributing to this included heightened attention to debt and deficits, optimism about a soft or no-landing scenario driven by robust economic data and growing political uncertainty.

Market sentiment was notably affected by increasing political uncertainty surrounding the US presidential election. Historically, market volatility tends to rise in the lead-up to elections as investors consider potential outcomes, and this cycle proved to be no different.

Market activity

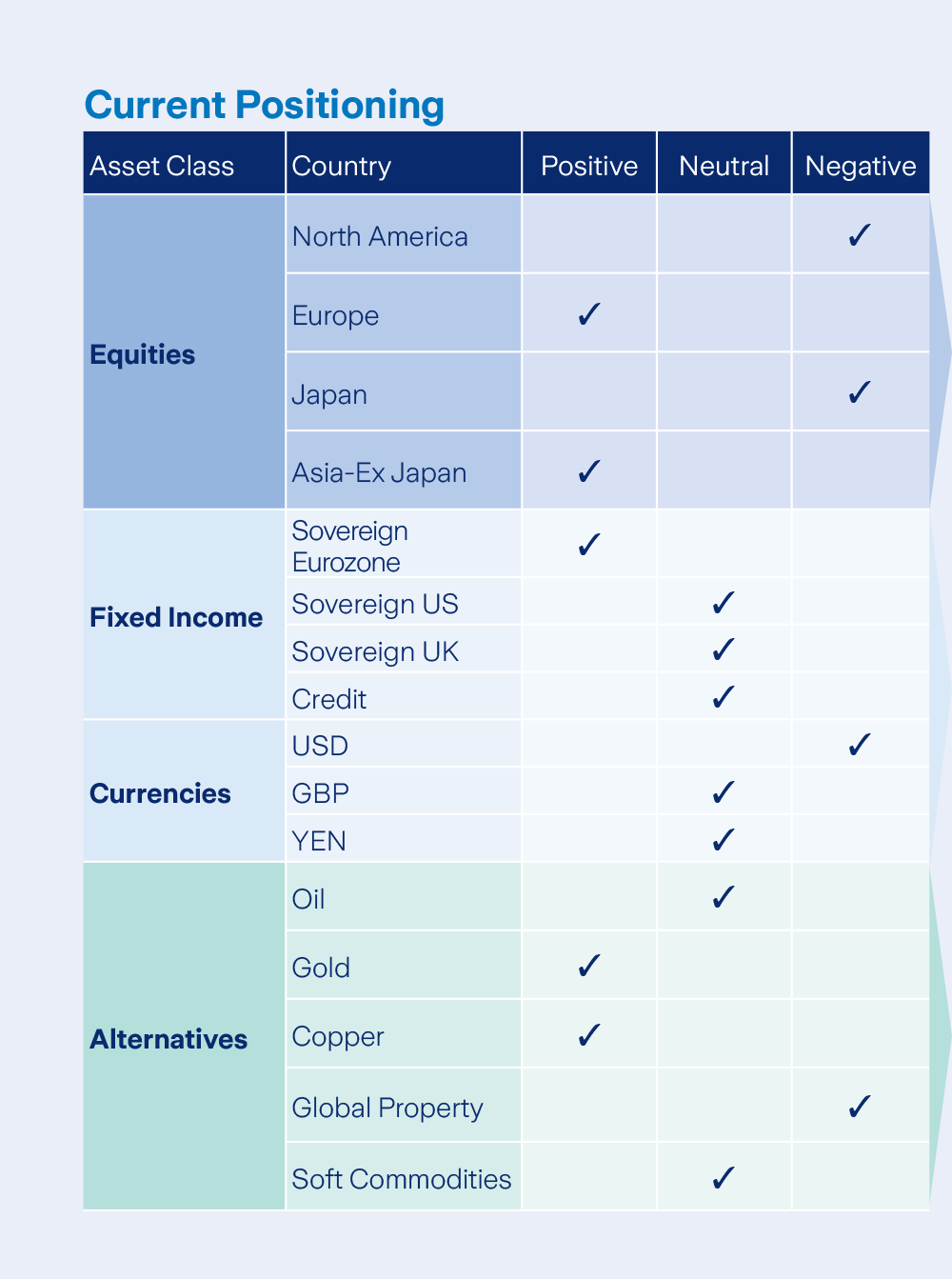

Throughout October there have been no material changes in asset allocation. Our current positioning is broadly neutral equities. We have an equity sector preference for technology, communication services and financials.

In fixed income allocation, we hold an overweight position in short-dated bonds over long-dated government bonds. We are overweight gold in the active asset allocation fund. Additionally, our partial Euro/Dollar hedge remains in place.

Equity markets

October was a volatile month for equity markets. The resilient US economy has supported equity performance, but returns are now transitioning from a focus on big tech to other sectors.

Uncertainty increased due to the upcoming US election and the potential impact of policy changes on inflation and interest rates.

In October, seven out of eleven sectors delivered negative returns in Euro terms. The materials and health care sectors experienced the steepest declines, with the materials sector falling by -3.6% and health care dropping by -2.6%. Conversely, the communication services and financials sectors led the gains, with returns of 3.7% and 2.9%, respectively.

Bonds and interest rates

After the Fed’s 50 basis point interest rate cut in September, persistent inflation readings highlighted the challenges facing US policymakers. The cooling expectations for further rate cuts, coupled with election uncertainty, have heightened the impact of the upcoming US election on the future direction of both fiscal and monetary policy. This will shape the outlook for inflation and, consequently, bond yields.

This uncertainty has contributed to the recent spike in bond yields, with 10-year Treasury yields increasing from 3.78% at the end of September to 4.28% over October. In Europe, the ECB recognised signs of weakening economic momentum and subsequently announced its third 25 basis point rate cut of the year, reducing the deposit facility rate to 3.25%.

Commodities and currencies

Commodity markets displayed mixed performance in October. Oil prices were particularly volatile, finishing the month up by 3.9% in Euro terms due to OPEC+’s decision to postpone plans to increase output by a month.

Gold continued to set new record highs, rising 6.6% in Euro terms, as investor caution remained high ahead of the US presidential election. Copper, often seen as an indicator of global economic health, declined by 1.1% in October. The USD strengthened against the Euro, with one Euro exchanging for 1.09 USD by the end of the month.

Warning: Past performance is not a reliable guide to future performance.

Warning: Benefits may be affected by changes in currency exchange rates.

Warning: The value of your investment may go down as well as up.

Warning: If you invest in these products you may lose some or all of the money you invest.