March 2025 monthly investment news

February, the shortest month of the year, felt extended due to the market volatility seen, writes Richard Temperley.

Global equities ended the month in the red, driven by weak US economic indicators such as declining consumer confidence and reduced manufacturing activity, heightening fears of an economic slowdown.

Trade tensions, particularly with the US imposing a 25% duty on Mexican and Canadian exports and a 10% tariff on Chinese imports, further dampened equity performance. In contrast, European stocks saw gains, driven by optimism that increased defence spending and a peace treaty between Russia and Ukraine might spur growth.

Treasury yields dropped amid worries that the tariffs could spark inflation, while in alternatives markets, copper prices climbed due to concerns over tariffs and supply issues.

Market activity

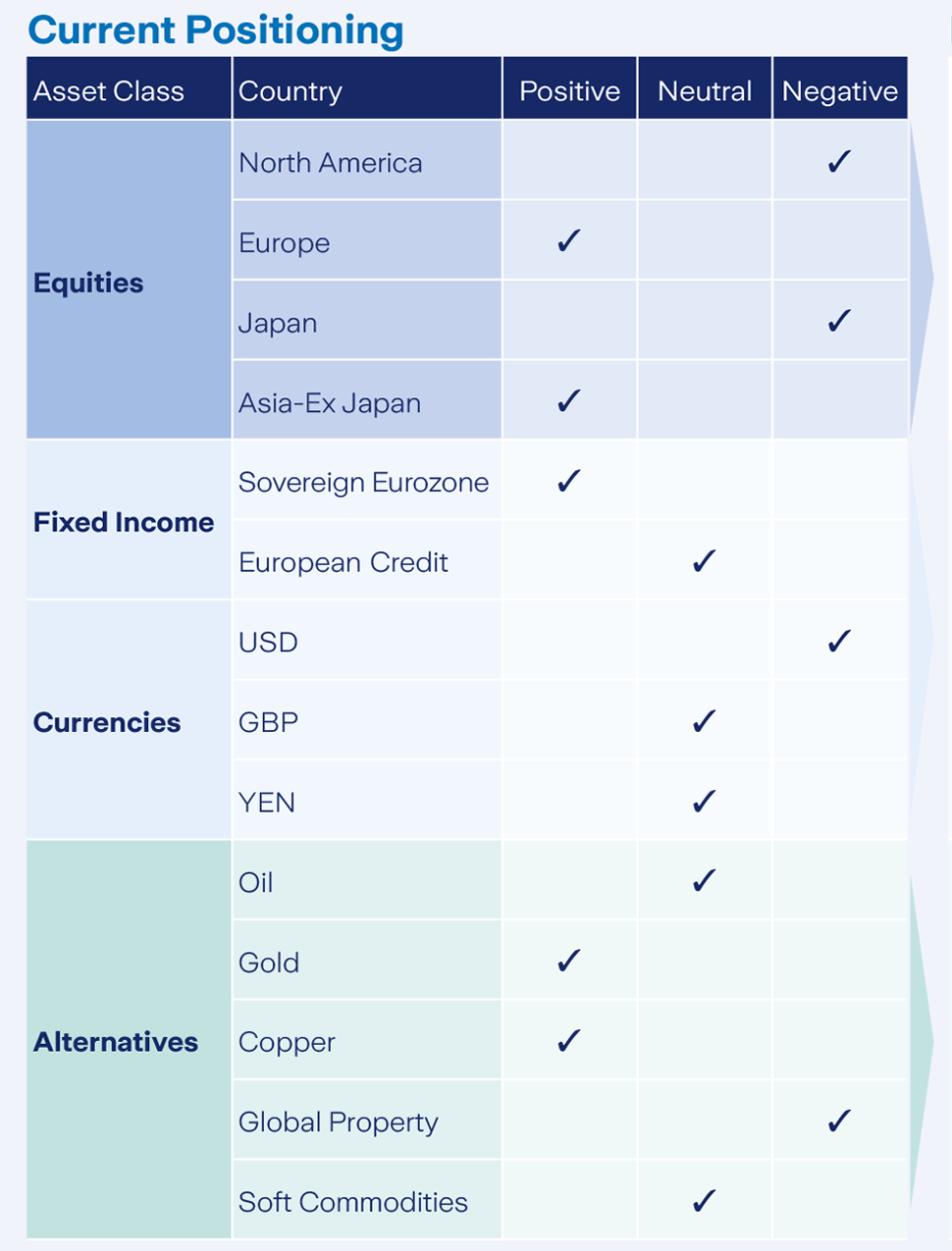

Our current position is modestly overweight equities and reasonably neutral bonds. At the end of January, we added to equities and added to the existing overweight in Gold.

In terms of regions, we are underweighting in North American equities matched by an overweight in Asia and Europe. Our Gold position is playing its role as a diversifier in the multi-asset funds. As at the end of February, our EUR/USD hedge remains in place. This is hedging approximately 15% of our USD holdings.

Equity markets

In February, global equity markets experienced increased volatility, driven by uncertainty over the impact of the US administration’s policy agenda and concerns over economic growth.

Europe outperformed the US, with Ireland standing out as the top performer, returning 12.8%, supported by optimism that progress could be made in negotiating a peace treaty between Russia and Ukraine. Additionally, there was a noticeable rotation within equities, with defensive sectors such as consumer staples and Real Estate emerging as top performers returning 4.7% and 2.9%.

We saw a widening of participation in the markets, tech lagged amid concerns about the sustainability of US mega-cap tech earnings which further pressured global growth stocks. Conversely, Chinese tech stocks exhibited positive momentum, fuelled by excitement about the implications of Deep Seek.

Bonds and interest rates

In February, fixed income markets performed well, providing diversification against equity losses. Yields on mid to long-term Treasuries fell over the month, with the 10 yr US Treasury ending the month at 4.21%, down from 4.54% at the end of January. Shorter-term yields remained largely unchanged.

Strong corporate fundamentals helped keep investment-grade spreads contained. However, there were concerns about the potential for tariffs to reignite inflation. US inflation rose to 3.0 % in January, leading to increased expectations of Federal Reserve rate cuts, further supporting bond prices.

Commodities and currencies

The US dollar weakened over the month, which boosted the returns of dollar-denominated global indices. By the end of the month 1 Euro purchased 1.038 USD. Factors such as rising fiscal deficits, high tariffs, and unpredictable foreign policies may lead to a subsequent weakening during Trump’s term. Supply concerns and threats of increased US tariffs on copper contributed to a rise in copper prices, with the metal returning 4.5% over the month, reflecting market apprehensions about future availability. Gold also performed well, returning 2.0% over the month.

Warning: Past performance is not a reliable guide to future performance.

Warning: Benefits may be affected by changes in currency exchange rates.

Warning: The value of your investment may go down as well as up.

Warning: If you invest in these products you may lose some or all of the money you invest.