March 2024 monthly investment news

In February, all three major US equity indices closed positively for the fourth consecutive month. The S&P 500 experienced its largest February gain in almost ten years, writes Richard Temperley.

The rally in stocks was primarily driven by increased investor interest in artificial intelligence (AI)-related technology companies. The leading AI chipmaker in the market (Nvidia) reported better-than-expected quarterly earnings growth, further supporting this trend. On the other hand, fixed income volatility persisted in February as market expectations for Fed rate cuts this year were adjusted.

As we entered 2024, there were expectations of five rate cuts, but this was revised down to three. As a result, bond yields increased across the US curve during the month. Given economic resilience and some signs of remaining inflationary pressures, central banks are expected to maintain their current stance for longer. Consequently, bond markets experienced declines due to the reduced likelihood of immediate rate cuts.

Activity

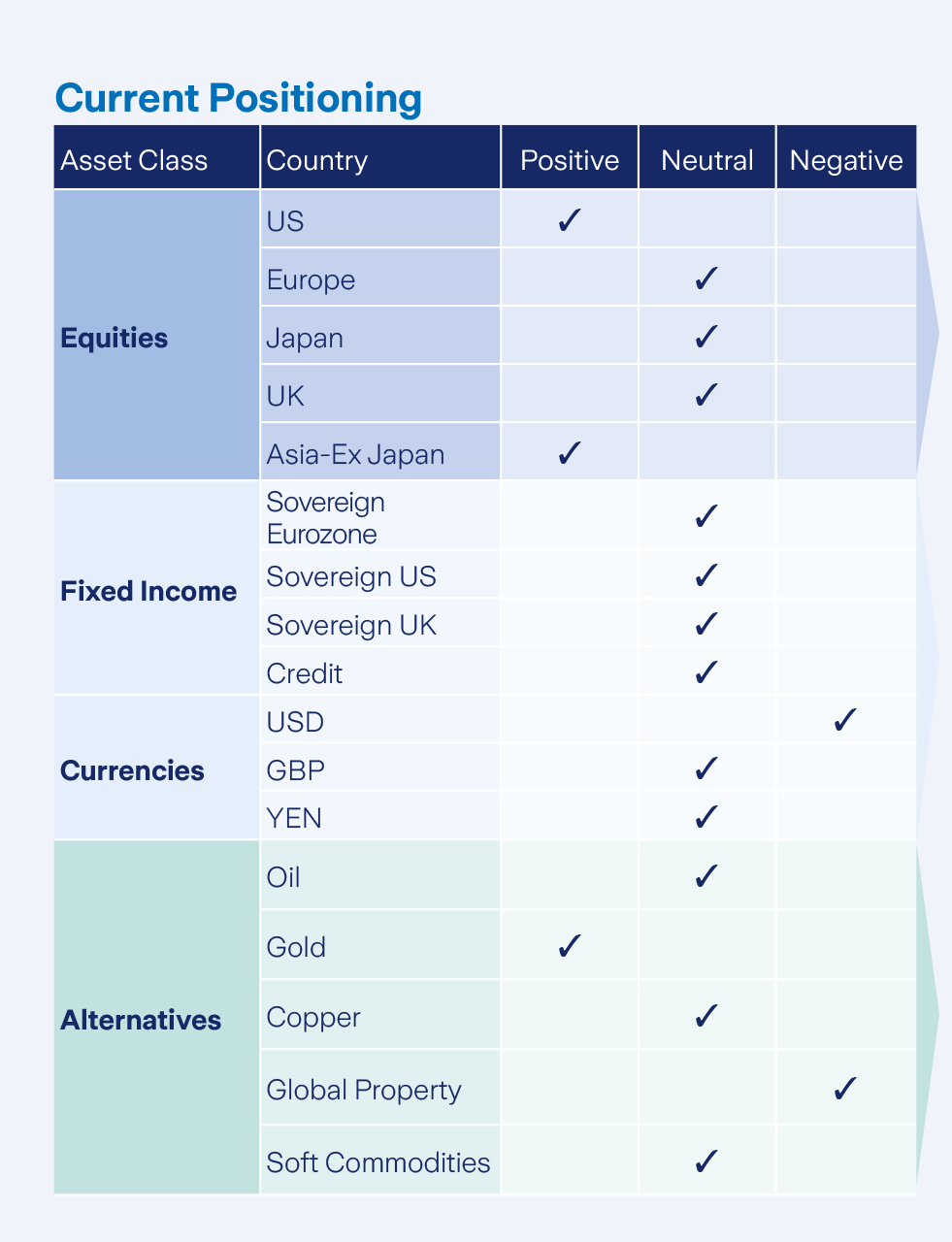

Our current positioning is broadly neutral equities and bonds and overweight short-dated bonds. Within fixed income portfolios we are looking for bond weakness to add duration. We are maintaining a shorter duration position in our bond portfolio allocation for now on the sense that yields may rise further from ‘higher for longer’ rates on better growth, possible inflation concerns, or government deficit funding concerns.

This also tempers our enthusiasm for equities if yields ratcheted higher. We have our equity weightings back down to neutral levels following the equity market rise experienced so far this year. Our EUR/USD hedge remains in place.

Equity markets

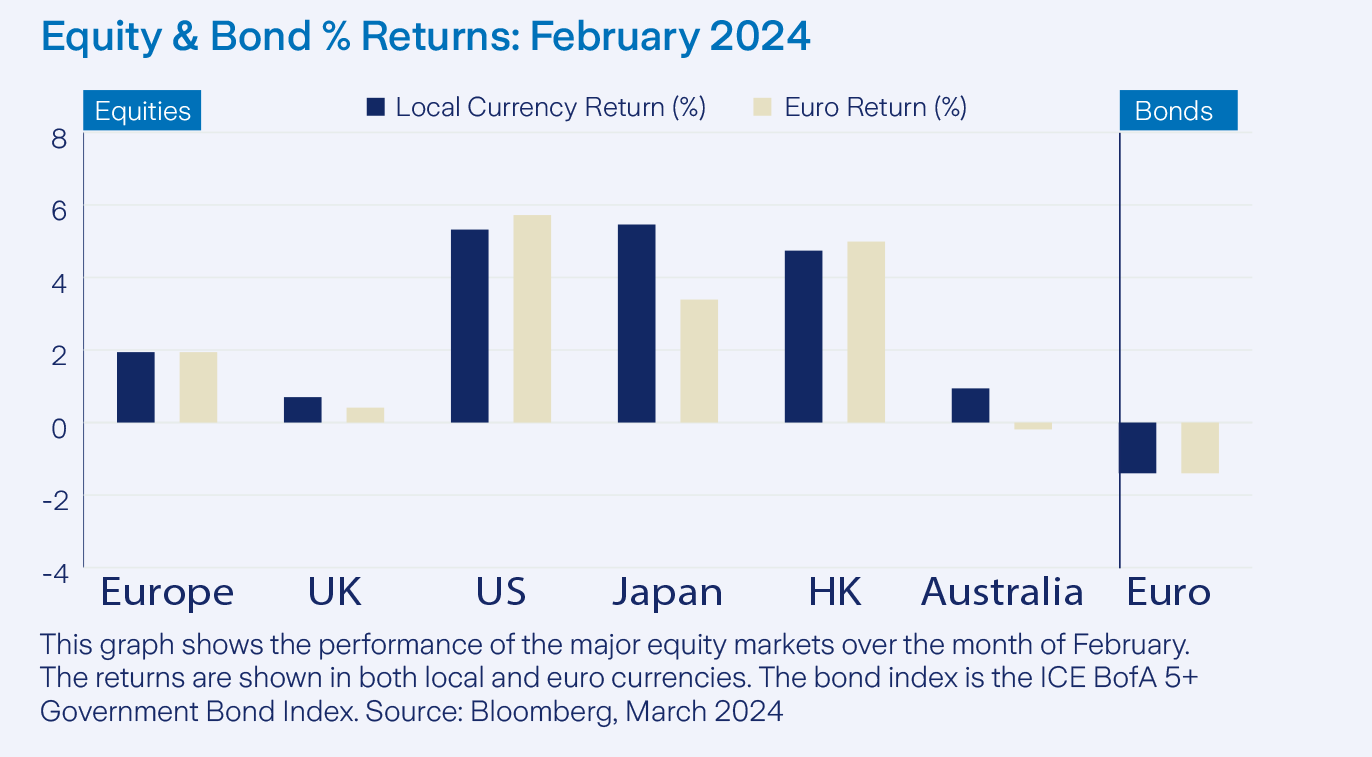

Equity markets were positive around the globe in February. Broadly, growth outperformed value in most regions. Globally the MSCI World returned 5.3% in Euro terms for the month, with the best performing equity sector in February being Consumer Discretionary, up 7.9%. Only the utilities sector finished in negative territory in February, returning -1.6%.

Interestingly, stock markets largely brushed off the recent rise in yields as investors focused on earnings rather than inflation. The best performing major market in Euro terms was US equities, pushed higher by its high concentration of large tech firms.

Bonds and interest rates

Fixed income markets saw a volatile month in February as uncertainty surrounding interest rates persisted. Key indicators of inflation such as higher than expected US CPI, strong employment levels and high non-farm payrolls were met with expectations of interest rates remaining higher for longer. The US Federal Reserve also engaged in a more hawkish tone following its policy meeting, contributing to upward pressure on interest rate expectations. The net effect saw bond yields rise as a result with the Benchmark US 10 Year treasury yield finishing the month at 4.25%, up from 3.91% the previous month.

Commodities and currencies

Overall, commodities saw negative performance throughout the month. Gold prices were lacklustre as the generally ‘risk on’ sentiment in equity markets saw outflows from the precious metal. However one commodity that saw positive performance was crude oil. Oil prices have been rising steadily over the past number of weeks as heightened geopolitical uncertainty contributes to upward pressure due to fears of future supply disruptions. Copper, which is often used as a barometer for global economic health, ended the month in negative territory.

Warning: Past performance is not a reliable guide to future performance.

Warning: Benefits may be affected by changes in currency exchange rates.

Warning: The value of your investment may go down as well as up.

Warning: If you invest in these products you may lose some or all of the money you invest.