June 2024 monthly investment news

Positive sentiment saw a strong month for both global equities and fixed income in May as investors grew more confident that central banks are on track to cut interest rates.

In the US, manufacturing and services activity displayed signs of strength, following a decline in April. Disinflation in the US however showed signs of slowing, with the Federal Reserve communicating slight concern over the path of inflation, pushing up bond yields towards the latter half of the month.

In Europe the ECB displayed a more positive view on inflation, indicating that rate cuts are imminent.

In Asia economic data surprised to the upside, news which was taken favourably amidst prolonged Chinese weak demand.

Investment market activity

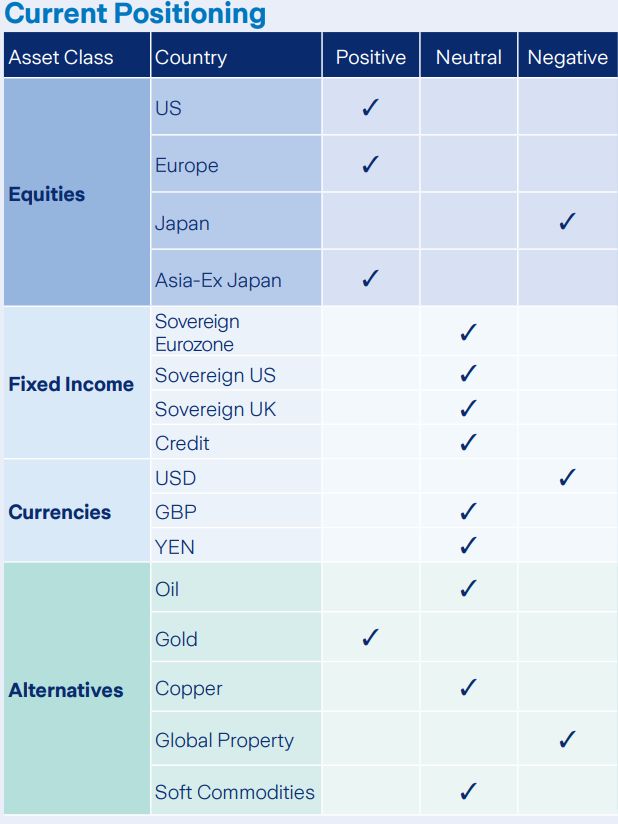

We continued to maintain a neutral equity position across our multi-asset funds throughout May. Within our equity allocation we remain focused on cyclical sectors such as Information Technology and Financials. On a geographical basis we have a slight preference for US, European and Asia Pacific regions.

Thematically, our active approach has taken advantage of secular trends in infrastructure, decarbonisation, and the development of treatment for diabetes and obesity. Within our fixed income allocation, we maintain a slight preference for lower duration bonds and have taken positions in peripheral over core sovereign bonds. Our Partial Euro/Dollar hedge remains in place.

Equity markets

Global equities had a positive month throughout May as markets rebounded following a negative April. In particular, cyclical and growth companies displayed favourable returns as investors repriced the potential for lower future interest rates. On a global sector level, Information Technology, Utilities, and Communication Services outperformed. Another area which brought momentum for equities was the release of strong earnings reports from many large corporations, with many releases surprising to the upside in the US. Globally, economic sentiment improved in May as the recovery in areas such as manufacturing activity broadened out, encouraging equities to move higher.

Bonds and interest rates

Bonds broadly showed positive returns throughout May as globally falling inflation continues to reduce inflation expectations. In the UK and Europe, central banks appeared poised to cut interest rates, whilst in the US disinflation stalled somewhat, adding some uncertainty to the Fed’s path in lowering interest rates. Corporate bonds performed well in May as economic strength and strong earnings reports suggested healthy fundamentals. The yield on the benchmark 10 Year treasury yield finished the month at 4.50%, lower than the previous month-end figure of 4.68%. In Japan, the yield on the benchmark 10 Year JGB rose above 1% as investors priced in the potential for interest hikes from the Bank of Japan.

Commodities and Currencies

Precious metals continued at their elevated level in May, with gold returning 1.8% in USD across the month and now sitting at 2327.33 USD per Troy Ounce. Energy related commodities such as oil however saw a negative month with crude WTI Crude Oil down -7.6% in Euro terms. Supply concerns for oil eased somewhat in May, although tensions remain elevated due to geopolitical developments in the middle east. In global currencies, the Japanese Yen encountered 34-year lows as expectations of hawkish monetary policy are weighing on the currency. The USD/JPY exchange rate finished the month at 157.31.

Warning: Past performance is not a reliable guide to future performance.

Warning: Benefits may be affected by changes in currency exchange rates.

Warning: The value of your investment may go down as well as up.

Warning: If you invest in these products you may lose some or all of the money you invest.