July 2024 monthly investment news

June saw strong performance for risk assets as inflation continued to moderate across the globe, writes Richard Temperley.

In the US, headline inflation fell, whilst the labour market appeared to soften which may leave more scope for the Federal Reserve to cut interest rates.

In the Eurozone, sentiment was slightly less rosy. An unexpected French snap election saw an increase in volatility, whilst in the UK growth in both manufacturing and services slowed.

June saw the European Central Bank (ECB) cut the key Euro Area interest rate for the first time since 2019. The ECB reduced rates by 25 basis points, in line with market expectations, bring the main interbank deposit rate to 3.75%.

Markets activity

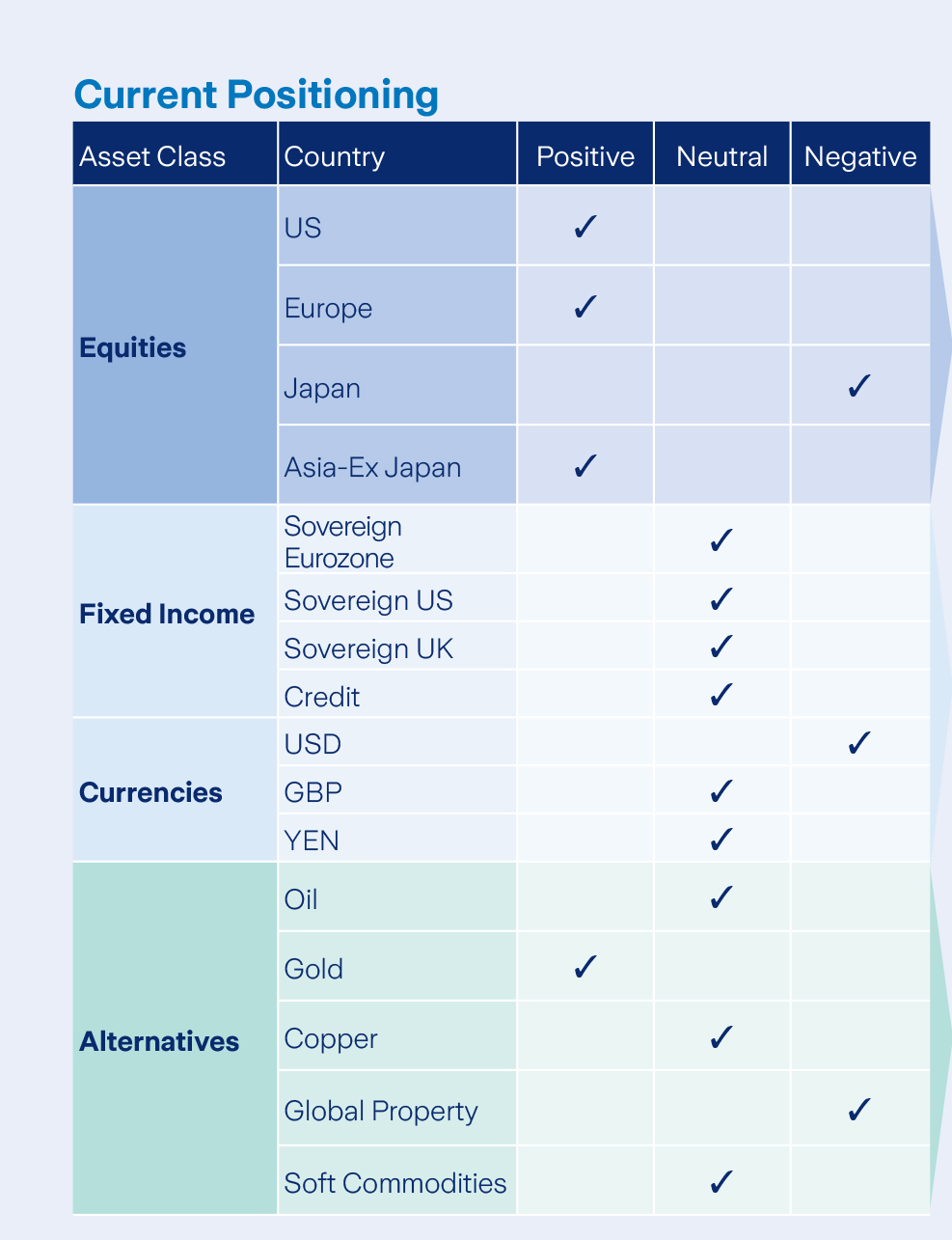

We continue to maintain a broadly balanced asset allocation stance across our multi-asset funds. Both the equity and fixed income components of our portfolio remain neutral as we are ready to pivot materially into either asset class as opportunities present themselves. This is an active neutral position which is being constantly monitored.

Within our equity component, we favour cyclical sectors such as Information Technology and Financials. On a geographical basis we maintain a slight preference for US, European and Asia Pacific regions.

Our fixed income allocation holds a modest short duration position and a broad geographical preference for so called ‘periphery’ over ‘core’ issuers. Our partial Euro/Dollar hedge remains in place.

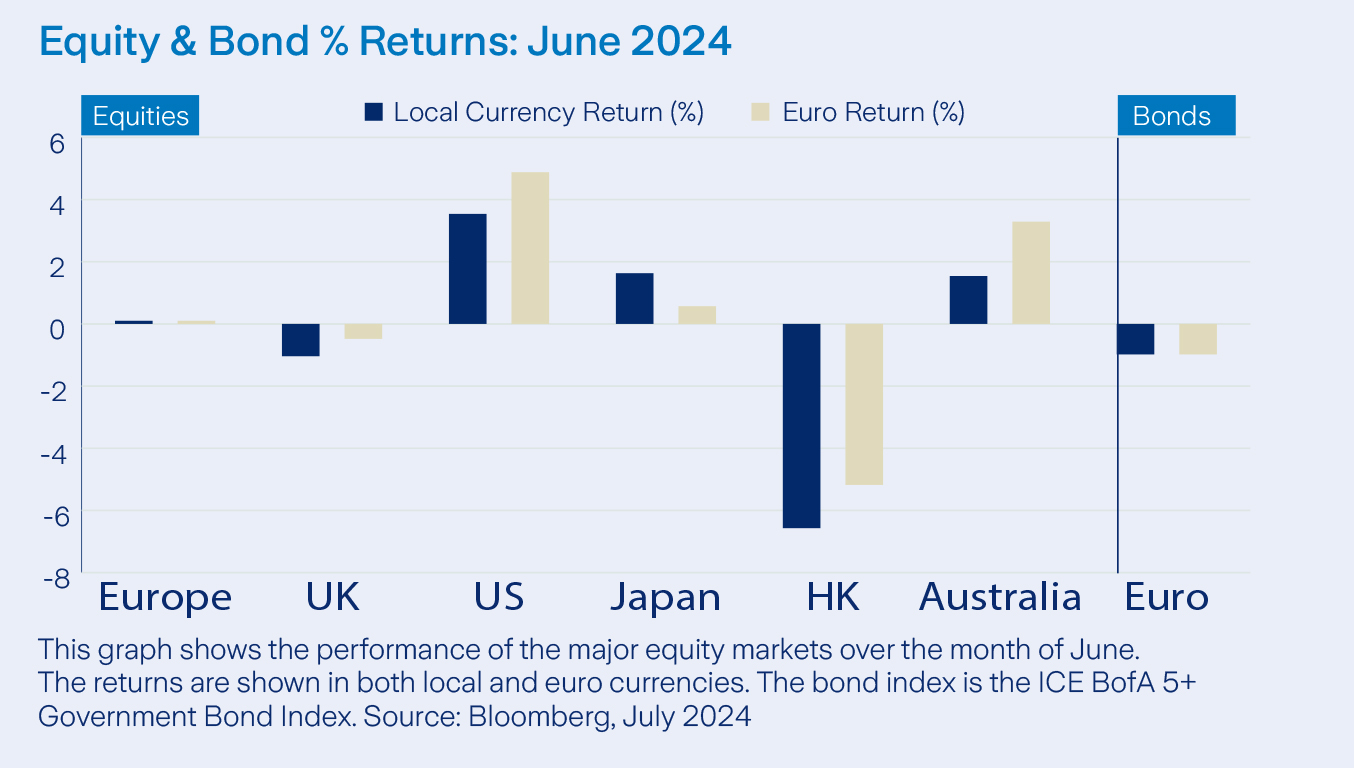

Equity markets

June was a positive month for equities in most major markets, barring the Eurozone and UK. US equities rallied on improved expectations for lower interest rates in 2024 along with strong performance in growth orientated sectors. US headline inflation figures, released in mid-June, showed that inflation decreased to 3.3% in May, down from 3.4% in April, below consensus expectations.

On a US sector basis, Information Technology, Consumer Discretionary and Communication Services performed best, whilst more defensive sectors such Utilities ended the month in negative territory.

In the Eurozone, political uncertainty hampered equity returns, with the election in France garnering much attention.

Bonds and interest rates

Yields lowered somewhat in June, on the back of lower interest rate expectations. The benchmark 10 year US Treasury yield finished the month at 4.40%, down from 4.50% at the previous month end. This came as the core Personal Consumption Expenditures Price Index, the Fed’s preferred measure of inflation rose by 0.08%, the smallest increase since 2020.

Inflation expectations continue to be a primary driver of markets. The ECB cut the main interbank rate, which was positive for Eurozone bond performance, however the aforementioned higher volatility, observed later in the month due to political uncertainty, paired back most of these gains by month end.

Commodities and currencies

It was another volatile month for commodities, with some major constituents of the sector displaying negative performance. However, Oil rose significantly across the month, largely because of reported lower inventory levels in the US, to finish up 5.8% in euro terms. Precious metals such as Gold were largely flat across the month. Gold has seen strong performance throughout the first half of 2024 due in part to expectations of a Federal Reserve interest rate cut in September. Copper, often used as a barometer of global economic health, was down -4.5% throughout June. At the end of the month 1 Euro purchased 1.07 US Dollars. The US Dollar strengthened against a basket of global currencies across the month.

Warning: Past performance is not a reliable guide to future performance.

Warning: Benefits may be affected by changes in currency exchange rates.

Warning: The value of your investment may go down as well as up.

Warning: If you invest in these funds you may lose some or all of the money you invest.