February 2025 monthly investment news

From Trump tariffs to concerns around the technology sector with the emergence of Chinese AI company DeepSeek, investors searched for safety in government bonds and commodities, writes Richard Temperley.

The return of President Trump to the White House, accompanied by his ‘America First’ policy agenda, provided a boost for US equities. However, the emergence of Chinese AI company DeepSeek raised concerns about the technology sector’s ability to meet high expectations and January certainly highlighted the risks associated with the significant concentration in the US stock market.

Stocks also came under pressure following Trump’s announced tariffs on Mexico, Canada and China. In their search for safety, investors turned to government bonds and commodities, whilst many currencies saw volatile swings against the US dollar.

Market activity

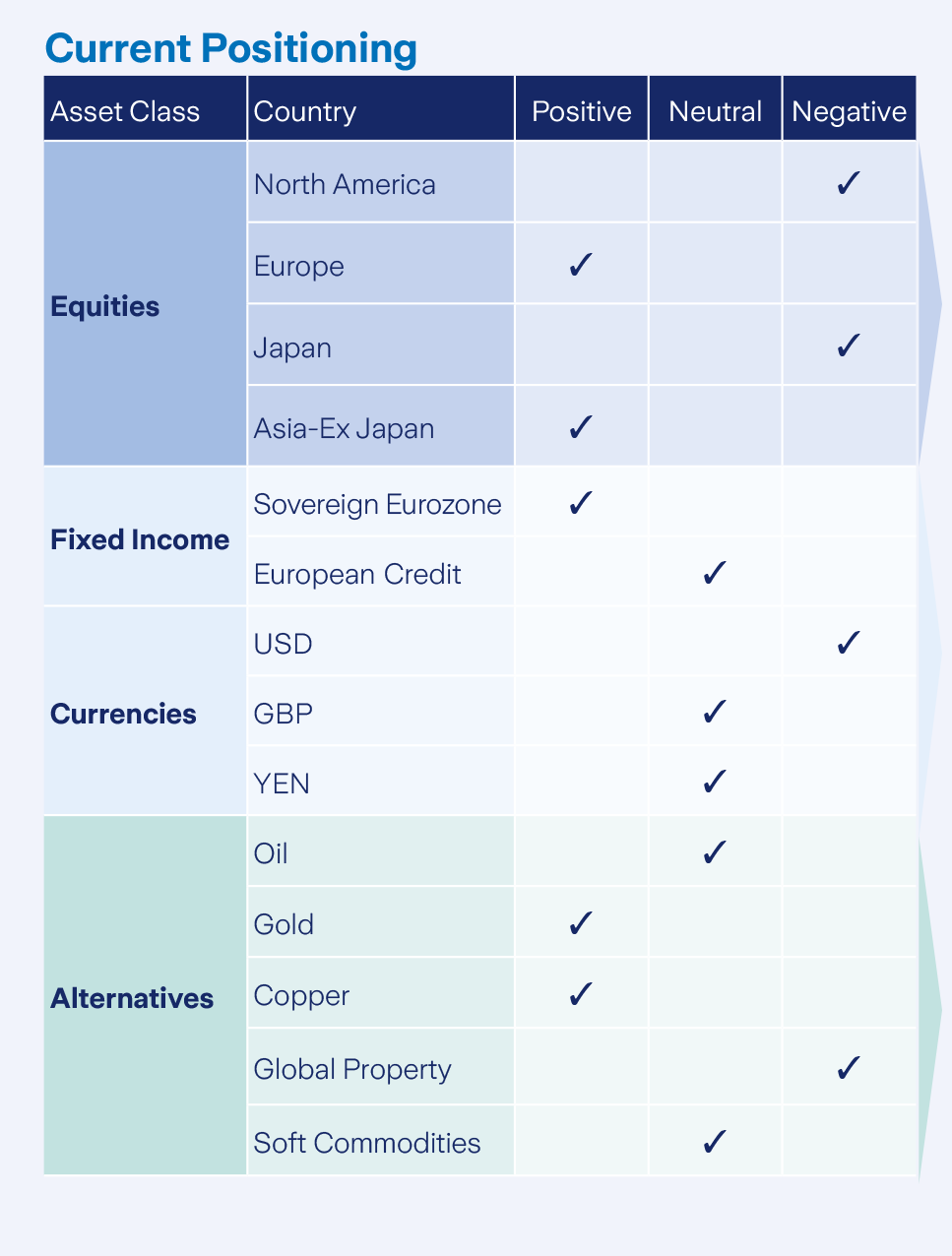

In January, we made several active asset allocation decisions. Within our multi-asset funds, we added to Gold, Active Fixed income, and Medium Term Corporate bonds - a move was funded by cash. This was followed later in the month by a positive asset allocation decision towards equities in our Active Asset Allocation (AAA) fund. We again added to Gold, taken from Short Bonds and Cash.

We are now slightly overweight equities in the AAA/ Prisma funds and overweight in alternatives, following the addition to gold. Our EUR/USD hedge remains in place.

Equity markets

Global equity markets kicked off 2025 with a 3.1% increase in Euro terms during January. The US equity market experienced a month of volatility, supported by mixed results in corporate earnings.

Concerns arose around Chinese start-up DeepSeek that its AI program could operate with less advanced computer chips and reduced power consumption. This news caused a sharp decline in AI-related tech stocks, with NVIDIA experiencing an almost $600 billion drop in market capitalization in one day.

Despite this setback, 10 out of the 11 sectors finished the month in positive territory. The Information Technology (IT) sector was the one to end negative, returning -1.6%, while communication services and financials were top performers, with returns of 8.7% and 6.5%.

Bonds and interest rates

Bond markets also experienced increased volatility in January. Trump’s proposed policies, including tax cuts, immigration restrictions, and tariffs, led to expectations of higher US inflation, causing yields to rise globally.

Labour market data triggered a sharp move higher in US bond yields that spilled into global bond markets. The US 10-year Treasury yield surged early in the month, reaching 4.79% before declining to end the month at 4.54%.

The Federal Reserve maintained the fed funds target range at 4.25% - 4.50%, as economic data continued to indicate a resilient labour market. As anticipated, the European Central Bank reduced its policy rates by 25 basis points, bringing the deposit rate to 2.75%.

Commodities and currencies

Commodities emerged as one of the standout performers of the month. Gold increased by more than 6.5% in Euro terms, and other metal prices also rose as investors sought safety amid a volatile stock market.

Oil began January on a strong note, lifted by cold winter weather and US sanctions against Russia. However, prices started to decline after Trump declared a “national energy emergency,” ending the month with a modest gain of 1.1% in Euro terms

By the end of the month, one euro purchased 1.036 USD, with the EUR/USD pair trading in the range of 1.024 to 1.050 throughout the month.

You can read the full monthly markets report to see how the markets are performing.

Warning: Past performance is not a reliable guide to future performance.

Warning: Benefits may be affected by changes in currency exchange rates.

Warning: The value of your investment may go down as well as up.

Warning: If you invest in these products you may lose some or all of the money you invest.