August 2024 monthly investment news

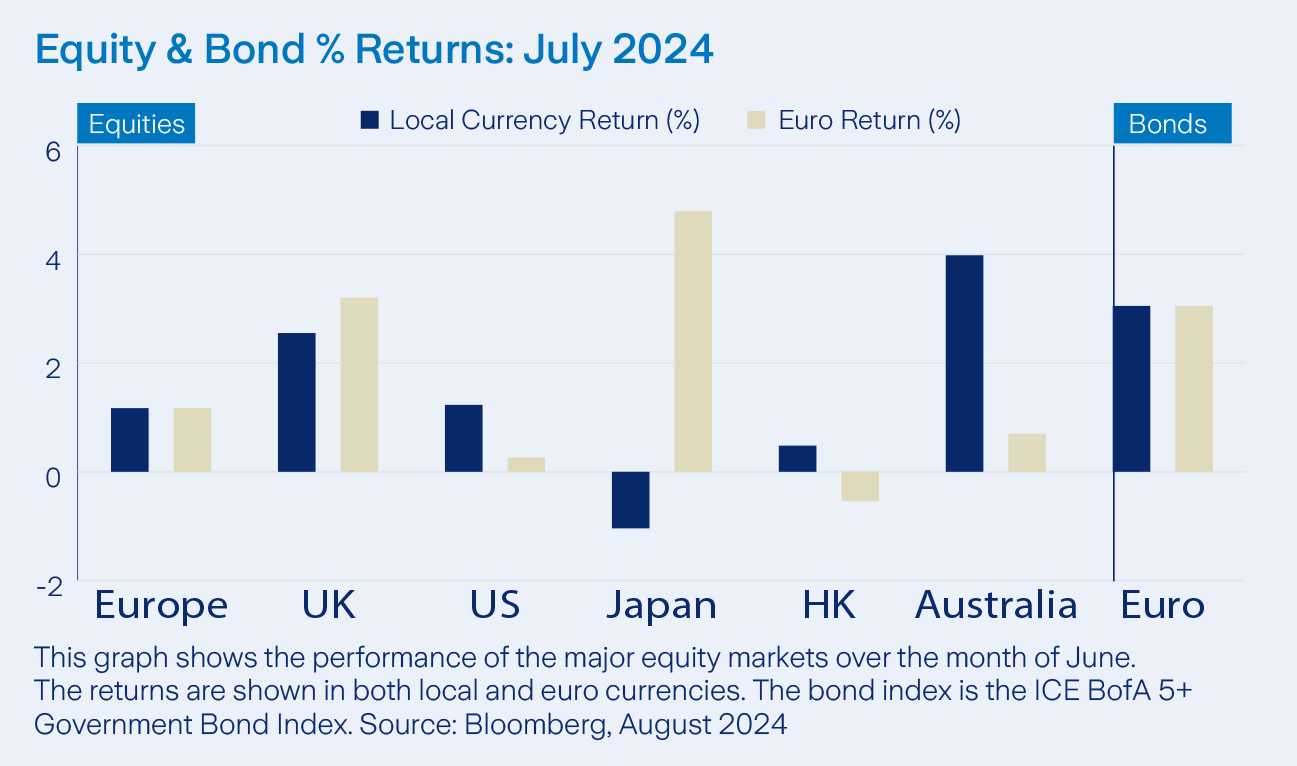

July saw mixed performance across asset classes with global equities experiencing corrections in some major markets, writes Richard Temperley.

The month saw US inflation decline to its lowest level in three years, coming in at 3.0% for June, increasing the likelihood of a Federal Reserve rate cut in September.

Q2 corporate earnings results also influenced markets in July, with high earnings expectations for tech firms proving difficult to beat. Although the number of companies beating analyst expectations remains above the long-term average, earnings surprises in Q2 have been more modest.

The month saw US President Joe Biden withdraw his candidacy from the Presidential Election, which garnered a muted response from markets. The policy implications from this election outcome continue to be a source of uncertainty.

In China, the economic picture remained sluggish as demand has struggled to reignite.

Activity

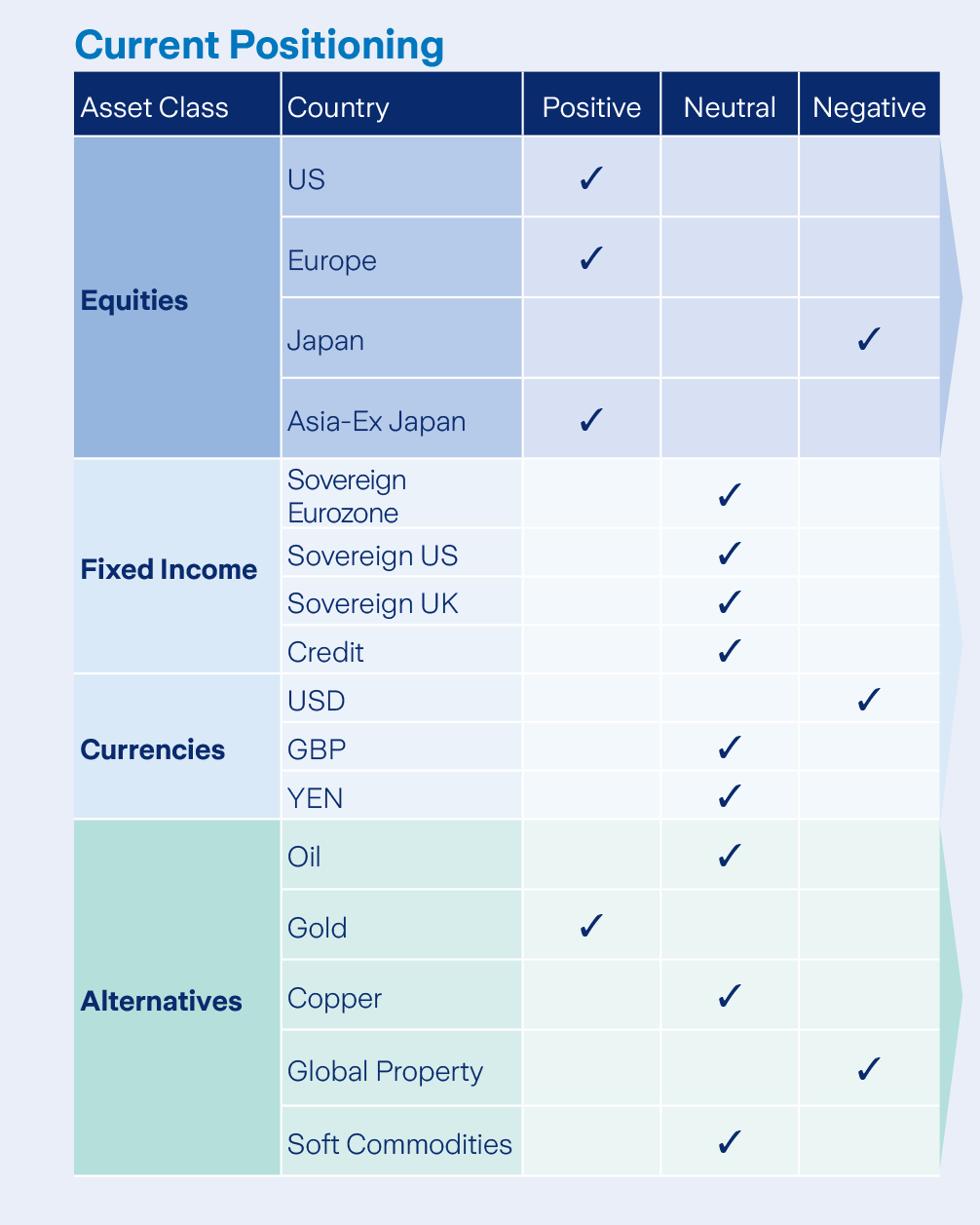

We have maintained our balanced asset allocation throughout July. Within our equity allocation we have a slight bias towards US equities and have availed of opportunities in sectors such as consumer staples amidst a recent rotation in stock market performance.

In terms of our fixed income allocation, we maintain our preference for peripheral sovereign issuers such as Ireland and Italy, over more traditional ‘core’ issuers such as Germany. We are relatively balanced from a duration viewpoint. We may act upon buying opportunities within either equities or fixed income, as they present themselves. Our partial euro/dollar hedge remains in place.

Equity markets

Equities witnessed a rotation in terms of sectors and style throughout July. With expectations of lower interest rates persisting, many investors saw opportunities in smaller cap companies, a change to the large-cap dominance prevalent so far in 2024.

On a global basis, the Real Estate and Utilities sectors performed best, up 5.7% and 5.5% in euro terms respectively. Sectors such as Information Technology and Communication Services saw the poorest performance, down -3.1% and -4.1% in euro terms. Despite this, these sectors remain the clear outperformers on a year-to-date basis.

Bonds and interest rates

Bond markets showed positive returns throughout the month, as yields fell on the growing expectation that inflation would reach levels targeted by central banks before the end of the year.

The benchmark US 10 Year Treasury yield finished the month substantially lower at 4.03%, down from 4.40% at the previous month end. Signs of economic weakness in the US also contributed to bond performance, as expectations of interest rate cuts increased.

At the end of July, the Federal Reserve opted to hold the benchmark interest rate steady in the 5.25%-5.50% range. In the ensuing press conference however, many commentators observed a notably more dovish tone.

Commodities and currencies

Gold prices continued their march higher in July, up 4.1% in euro terms. The precious metal has seen impressive performance year-to-date. The base metal Copper, which is often used as a barometer for global economic health, however, saw negative performance, down -4.8% in euro terms. This came as indicators for economic momentum appeared to slow in July.

Geopolitical uncertainty was also a feature of the month, particularly as tensions in the middle east remain elevated whilst a US election looms in November. Oil prices were notably lower albeit volatile, down -5.5% in euro terms.

At the end of the month, the euro dollar exchange rate continued to oscillate within its recent range, with one euro purchasing 1.08 USD.

Warning: Past performance is not a reliable guide to future performance.

Warning: Benefits may be affected by changes in currency exchange rates.

Warning: The value of your investment may go down as well as up.

Warning: If you invest in these products you may lose some or all of the money you invest.