September 2024 monthly investment news

August was an eventful month for investors. Early on, the release of disappointing US economic data, coupled with an interest rate hike by the Bank of Japan, triggered a significant sell-off in global equity markets, writes Richard Temperley.

By the end of the month, the markets had bounced back as investors began anticipating more aggressive policy easing from the Federal Reserve. Throughout August, US economic data presented a mixed picture.

The unemployment rate unexpectedly climbed to 4.3%, its highest level in nearly three years, while the rate of job gains slowed. Nonetheless, real-time GDP estimates suggested another quarter of economic growth.

Inflation continued its downward trend, with the headline rate slipping to 2.9% and the core rate to 3.2%. At the annual Jackson Hole summit, Powell remarked that “the time has come for policy to adjust,” indicating that the Federal Reserve is likely to start its easing cycle in September. In the Eurozone, headline inflation dropped to 2.2% in August, marking its lowest level in three years.

Market activity

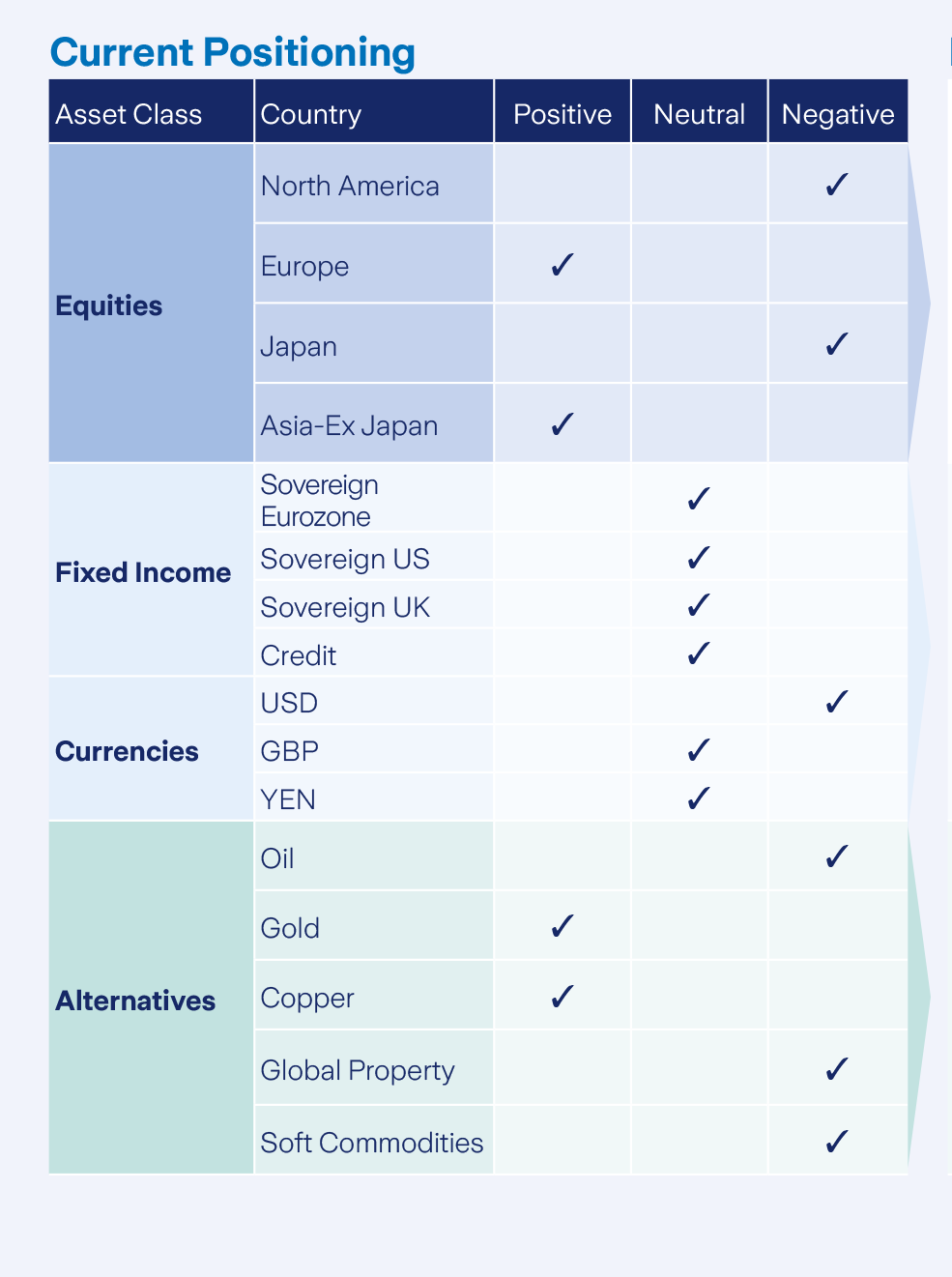

Throughout August, we have maintained a balanced asset allocation. Within our equity portfolio, we have a slight overweight position towards Asian and European equities and have capitalised on opportunities in sectors such as financials, materials, and information technology, whilst benefiting from a recent rotation in stock market performance.

At the end of the month, we decreased our overweight position in gold and increased our exposure to industrial metals, specifically copper, in our Active Asset Allocation (AAA) fund, which will be proportionately reflected in the Prisma funds.

Regarding our fixed income allocation, we hold an overweight position in short-dated bonds within the AAA/ Prisma funds and are monitoring for renewed bond weakness to extend duration. We remain open to availing of buying opportunities in either equities or fixed income as they arise. Additionally, our partial euro/dollar hedge remains in place.

Equity markets

The month started with a significant sell off in equities due to disappointing US employment data and an unexpected rate hike in Japan, which disrupted currency carry trades. However, in the final weeks, equities recovered most of the earlier losses as investors seized the opportunity to buy the dip following a nearly 10% decline.

A series of positive US economic data points and a robust second-quarter earnings season provided further momentum for the rally. Growing optimism for rate cuts continued to support small-cap stocks throughout the month.

Globally, the real estate and health care sectors performed the best, rising 3.78% and 3.37% in euro terms, respectively. Conversely, many sectors experienced a negative month, with energy and consumer discretionary sectors seeing the poorest performance, down -2.92% and -1.34% in euro terms.

Bonds and interest rates

Bond markets delivered positive returns throughout the month, as yields declined amid growing expectations that inflation would reach central bank targets by year-end. The benchmark US 10-Year Treasury yield ended the month lower at 3.90%, down from 4.03% at the previous month’s close. It appears the Federal Reserve may be nearing the final stages of its battle against rising prices, as economic data suggests reduced upside risks to inflation.

Economic indicators, including GDP figures, pushed yields back up as optimism for a ‘soft landing’ prevailed. In his speech at the Fed’s annual conference in Jackson Hole, Fed Chair Jerome Powell remarked that “the time has come for policy to adjust,” indicating rate cuts in September.

Commodities and currencies

Commodity markets experienced mixed performance in August. Oil prices were particularly volatile, ending the month down by 7.5%. This decline was driven by growth concerns in the US and China, coupled with the risk of supply disruptions due to the potential expansion of conflict in the Middle East.

Gold performed relatively well, gaining 2.28% in USD terms, fuelled by rising expectations of interest rate cuts by the US Federal Reserve. In contrast, copper, a base metal often considered a gauge of global economic health, experienced a decline, down 1.8% in euro terms. By the end of the month one euro bought 1.10 USD.

Warning: These figures are estimates only. They are not a reliable guide to the future performance of your investment.

Warning: This product may be affected by changes in currency exchange rates.

Warning: The value of your investment may go down as well as up.

Warning: If you invest in this product you may lose some or all of the money you invest.

Related articles

Filter by category

Follow us on

Sending Response, please wait ...

Sending Response, please wait ...

Your response has been successfully submitted.

An error has occurred attempting to submit your response. Please try again.