May 2024 monthly investment news

April marked a shift in investor sentiment as a series of higher readings from inflation metrics in the US saw investors re-evaluate their interest rate expectations. Higher inflation triggered stock markets to pull back from recent highs as the Federal Reserve’s willingness to cut interest rates decreased, writes Richard Temperley.

Throughout the month, the first corporate earnings for Q1 of 2024 were released. The results held up better than expected for many large corporates, leading investors to digest both positive and negative surprises in April.

Outside of the US, several major central banks signalled rate cuts in the near future, with the ECB likely to begin cutting in June in contrast to that of the Fed. Globally, economic growth continues to expand in line with recent trends, with services activity remaining robust and manufacturing activity gradually improving.

Investment market activity

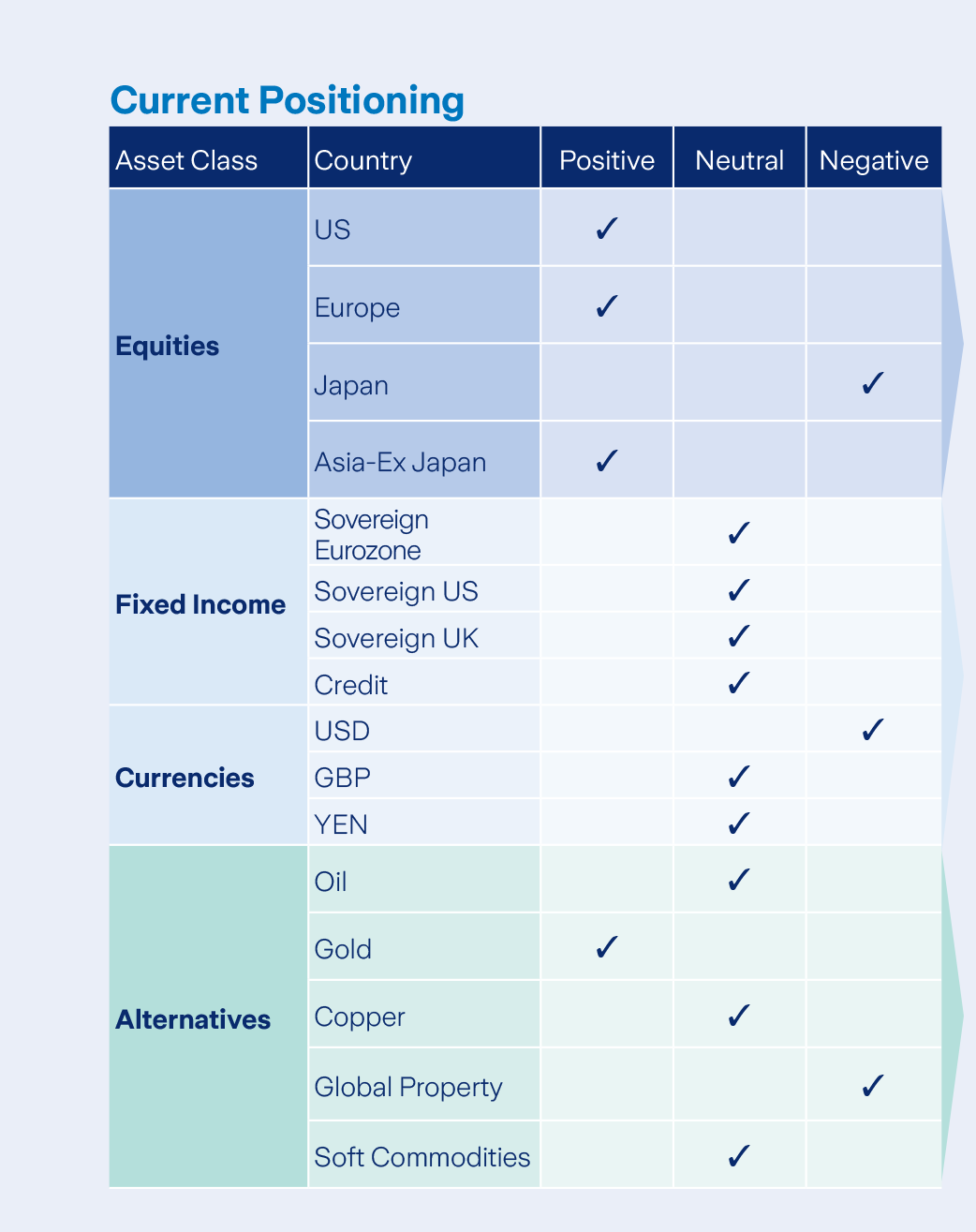

We continue to maintain a neutral position in equities across our multi-asset funds. Our balanced position has allowed us to avail of improved yields as we continue to assess the global economy. Our equity position continues to hold a cyclical bias with a slight underweight position in sectors such as Real Estate and Consumer Staples.

Within our fixed income allocation, we have a preference for shorter dated bonds and have also taken some positions in Italian and Spanish sovereign debt over core sovereign issuers. We remain flexible in this respect and may add duration in the case of bond market weakness. Our partial Euro/USD hedge remains in place.

Equity markets

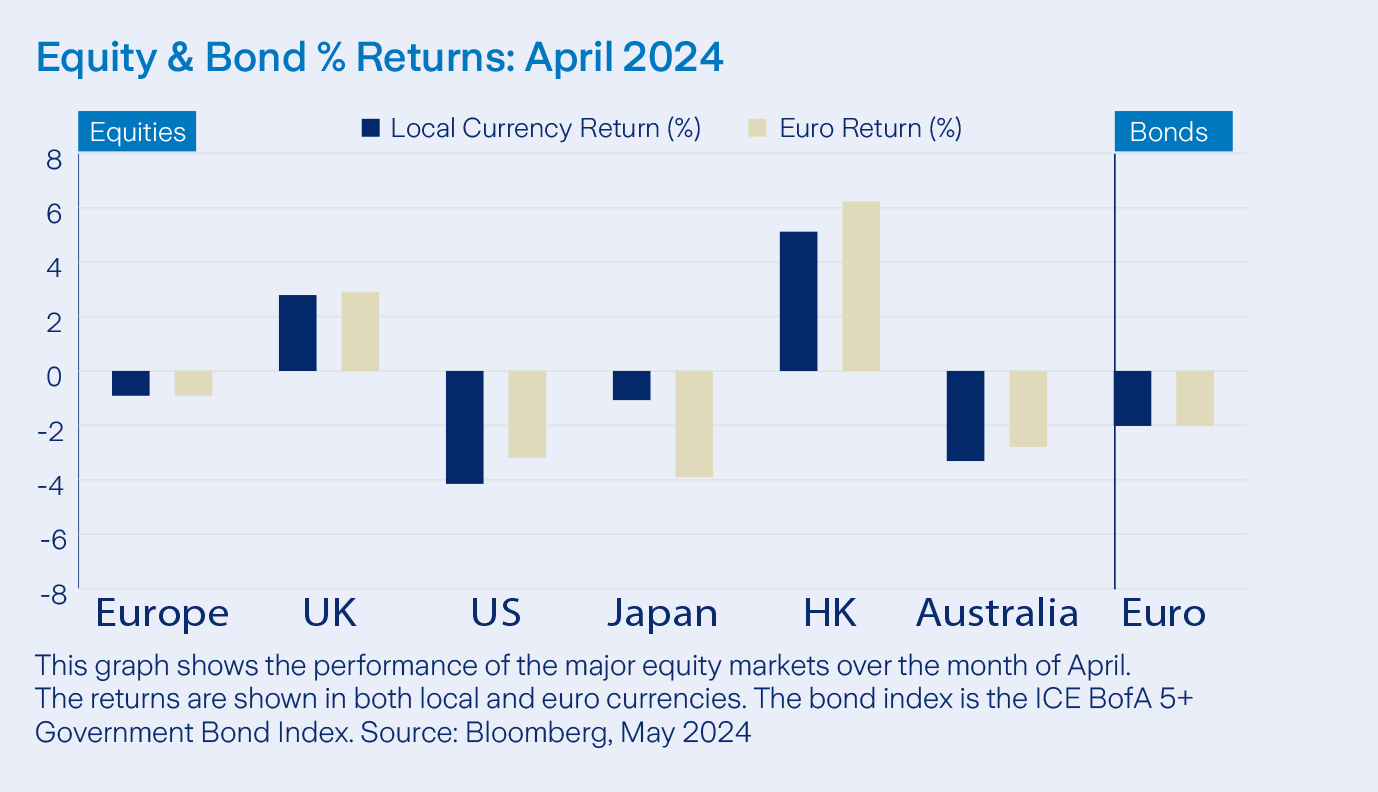

April was a mixed month for equities, as inflation concerns in the US emerged, curbing investors interest rate cut expectations from the Fed. Global equities ended the month in negative territory with the US and Japanese markets being the main detractors to performance.

On a sectoral basis, defensive stocks in the Utilities sector outperformed whilst Consumer Discretionary and Information Technology lost some of their recent momentum.

In the US, Utilities and Consumer Staples were the only sectors in euro terms to provide positive returns, whilst Real Estate and Health Care saw the poorest performance.

Bonds and interest rates

Fixed income markets were primarily influenced by developments in the US throughout April which caused investors to re-evaluate broad rate cut expectations.

Midway through the month, March inflation figures for the US surprised to the upside, with headline inflation rising to 3.5%. The Federal Reserve also indicated that many FOMC members had expressed concern that inflation levels were not moving lower at a fast enough pace. Consequently, bond yields rose steadily as investors priced in higher interest rates for longer. The yield on the benchmark US 10 year finished the month at 4.68%, its highest level in 2024.

Commodities and Currencies

Commodity markets saw upward moves in April, with both base and precious metals showing particularly strong performance. Gold in euro terms returned 3.72% whilst Silver saw performance of 6.56% in euro terms across the month. Copper, often used as a barometer for global economic health, returned 14.15% in euro terms. This comes as demand increases with a more favourable economic outlook globally.

Oil proved to be more volatile in April amidst heightened geopolitical tensions, with WTI Crude Oil down -0.35% in euro terms. At the end of the month 1 euro purchased 1.08 US dollars. The USD has shown renewed strength against a basket of other major currencies as interest rate expectations remain elevated.

Warning: Past performance is not a reliable guide to future performance.

Warning: Benefits may be affected by changes in currency exchange rates.

Warning: The value of your investment may go down as well as up.

Warning: If you invest in these products you may lose some or all of the money you invest.

Related articles

Filter by category

Follow us on

Sending Response, please wait ...

Sending Response, please wait ...

Your response has been successfully submitted.

An error has occurred attempting to submit your response. Please try again.